Why Stable Value Now

As we turn the page on 2024 and look ahead to 2025, the U.S. fixed income market is facing some consequential unknowns, including how quickly the incoming Presidential administration will be able to implement its stated policy objectives and the ongoing evolution of the Fed’s monetary policy. These uncertainties appear to be driving a low level of conviction in the future path of interest rates. It is impossible to predict how these unknowns will be resolved and how the fixed income markets will react, but the odds of a newly funded stable value portfolio outperforming short-term alternatives may be more likely to be stacked in investors’ favor.

While the Fed has set lower expectations for further policy rate cuts and the U.S. Treasury yield curve remains relatively flat, the increase in longer-term interest rates has improved the return expectations for stable value investments. For large defined contribution plan sponsors that could consider replacing a money market and/or short-term bond fund with stable value, a newly funded stable value account’s ability to capture higher current market yields provides an attractive expected return with a high probability of outperforming cash rates going forward.

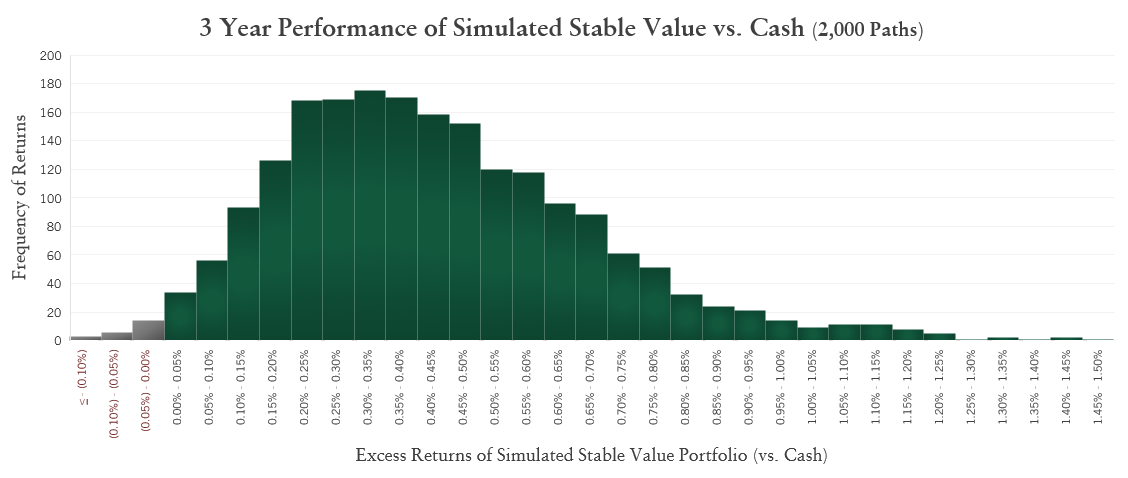

To analyze this probability, we constructed a scenario analysis to model a simulated, newly funded 3-year duration stable value portfolio versus cash rates using current market rate expectations over a 36-month time horizon. To account for its associated fees and expenses, the simulated stable value portfolio is assumed to earn a conservative yield of 30 basis points in excess of the 3-year Treasury bond. Over the 2,000 paths generated in this analysis, the modeled stable value portfolio provides a mean average annual crediting rate of almost 5% over the 36-month horizon. Over the 2,000 scenarios considered in this analysis, the simulated stable value portfolio outperforms cash rates in 99% of scenarios, with a distribution skewed toward favorable outcomes (see figure below).

To further test these results’ sensitivity to current market expectations, we shocked the forward curve used in the analysis by 100 basis points higher and lower. The result? When the three-year forward cash rate used in the model is decreased by 100 basis points, the simulated stable value portfolio's mean average annual crediting rate falls to 4.4%, as the portfolio reinvests at lower yields, but still outperforms cash rates over the 3-year horizon in 97% of scenarios. When the three-year forward cash rate used in the model is increased by 100 basis points, the simulated stable value portfolio's mean average annual crediting rate improves to 5.6% and outperforms cash rates in more than 99.5% of scenarios.

This model certainly does not consider all possible scenarios. For example, scenarios in which the cash rate increases while the 3-year Treasury rate is bound at lower levels would produce more adverse outcomes. However, the modelling utilized is consistent with current forward market pricing and demonstrates how a newly funded stable value portfolio can capitalize upon the increase in longer-term rates. In the face of uncertainty, a stable value portfolio is designed to provide consistent, stable returns over a range of interest rate scenarios.

Data as of 12/23/2024. Model scenario assumptions: The model uses a Monte Carlo simulation to model money market rates and 3-year Treasury rates over 36-months. Using forward cash rates as of December 23, 2024 and the Cox-Ingersoll-Ross (CIR) model, we constructed 3-year rates along each path at each time step using no arbitrage assumptions and modeled a 3-year duration stable value portfolio with an assumed spread of 30 basis points over the 3-year Treasury rate on each path with no cash in- or out-flows. This interest rate model is consistent with forward rates and captures the current shape of the yield curve. In addition, to evaluate the sensitivity of the results to current forward cash rates, we shocked the forward curve up and down 100 basis points. For each forward curve, we simulated 2000 paths.

The information contained herein reflects the views of Galliard Capital Management, LLC and sources believed to be reliable by Galliard as of the date of publication. No representation or warranty is made concerning the accuracy of any data and there is no guarantee that any projection, opinion, or forecast herein will be realized. The views expressed may change at any time subsequent to the date of publication. This publication is for informational purposes only; it is not investment advice or a recommendation for a particular security strategy or investment product.